breadcrumb navigation:

- Home /

- current page Case Study: Achieving Financial Viability in Social Impact: The Building Blocks

Case Study: Achieving Financial Viability in Social Impact: The Building Blocks

Published on

Updated:

Authored by Anonymous

Achieving Financial Viability in Social Impact: The Building Blocks

by Senait Petros Tekeste | Contributors: Deborah Kimathi & Habeeb Kolade

Introduction: Financial Viability in Context

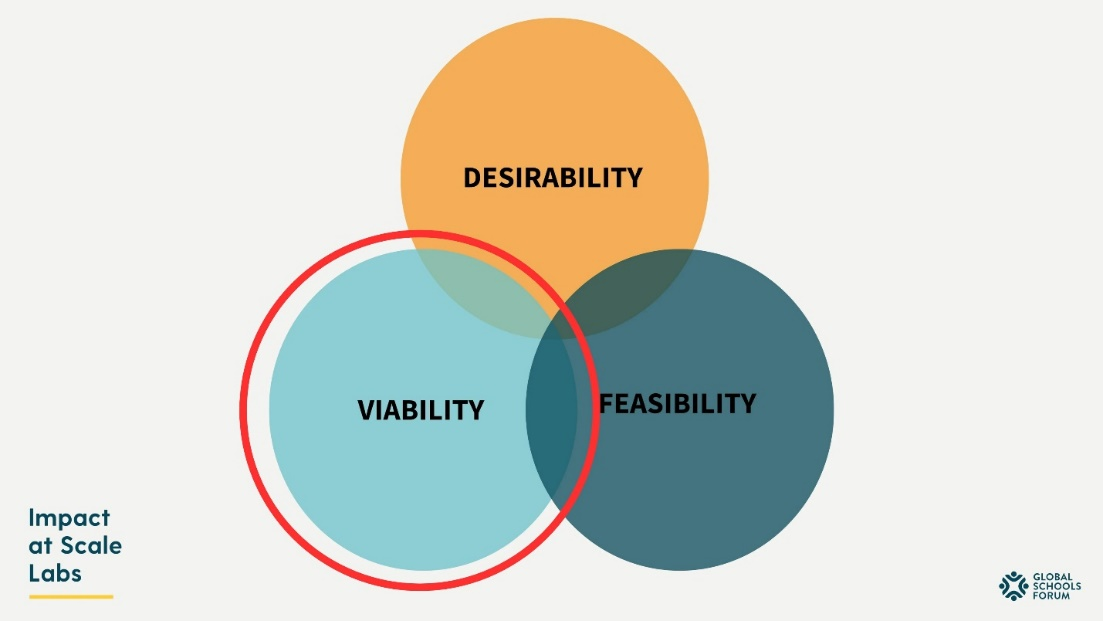

Financial viability is a strong determinant of the potential of an organisation to deliver their solutions’ impact at scale. At the Impact at Scale Labs, education organisations are aided on their scale journey using the DVF (Desirability, Viability, Feasibility) Framework to guide scale success. Among these three crucial pillars, the viability component focuses on the financial health of the organisation, cost to deliver the solution, the sustainability of the solution, sources of consistent revenue, channels for mitigating and optimising cost, and cost for monitoring, improving and adapting the solution at scale based on data etc. Nonprofit education organisations must manage these various viability components as they navigate funding challenges, economic fluctuations, and evolving programmatic needs.

This article focuses on the building blocks of financial viability and shares a case study of how Dignitas, a nonprofit education organisation, is strengthening the financial viability of their LeadNow program.

*The DVF Framework components: https://globalschoolsforum.org/impact-scale-labs-journey

_______________________________________________________________________________________

Key takeaways for organizations in social impact:

1. The Mindset of Applying a Financial Value Prism:

Social Impact Organisations often require a fundamental shift in mindset and approach when applying the financial viability lens. For Dignitas, some key areas of reflection to strengthen their financial viability included:

- Striking the right balance as they seek to pursue organisational sustainability through the diversification of income streams. How can they strategically identify the place of a fee-paying service with donor-funded services? How does this impact organisational identity, processes, and team structure?

- How does this impact the organisation's culture, language, and communication, and how does a social impact non-profit find the right culture and language in a world and dictionary created for a more commercialised and capitalist view of profit? For example, the use of the word “profit;” focus on sales; perception of fee-paying services etc.

- What determines the right level of financial viability confidence to scale up i.e. confidence in your product, price point, a customer’s ability to pay and how this may affect your identity as a social impact organisation with other actors like your partners, funders and beneficiaries?

- How does the organization define and prioritize scale-up options?

2. The Challenge of Quantifying Financial Value in Public Service:

Calculating financial viability requires clarity of the program's cost and benefit (the monetary value). This poses a critical challenge for most social impact organizations. For example, how do you put a financial value on a measure of teaching improvement or learning gains? Do you revert to Learning-Adjusted Years of Schooling (LAYS) and the country-based cost of each additional year of schooling?

A key part of resolving similar challenges is establishing practical definitions of the organization’s benefits and quantifying the financial value of these benefits - acknowledging that quantifying financial benefits in the social impact can be very complicated. The approach needs to articulate and build in assumptions as much as possible.

3. The Need for a Structured Approach to Assess Financial Viability:

A clear repeatable methodology enabling the organization to assess its program's financial viability is key. This methodology helps the organisation decide confidently which growth option has the greatest benefit and the lowest cost to maximize “profit” (value/benefit) and impact for the product.

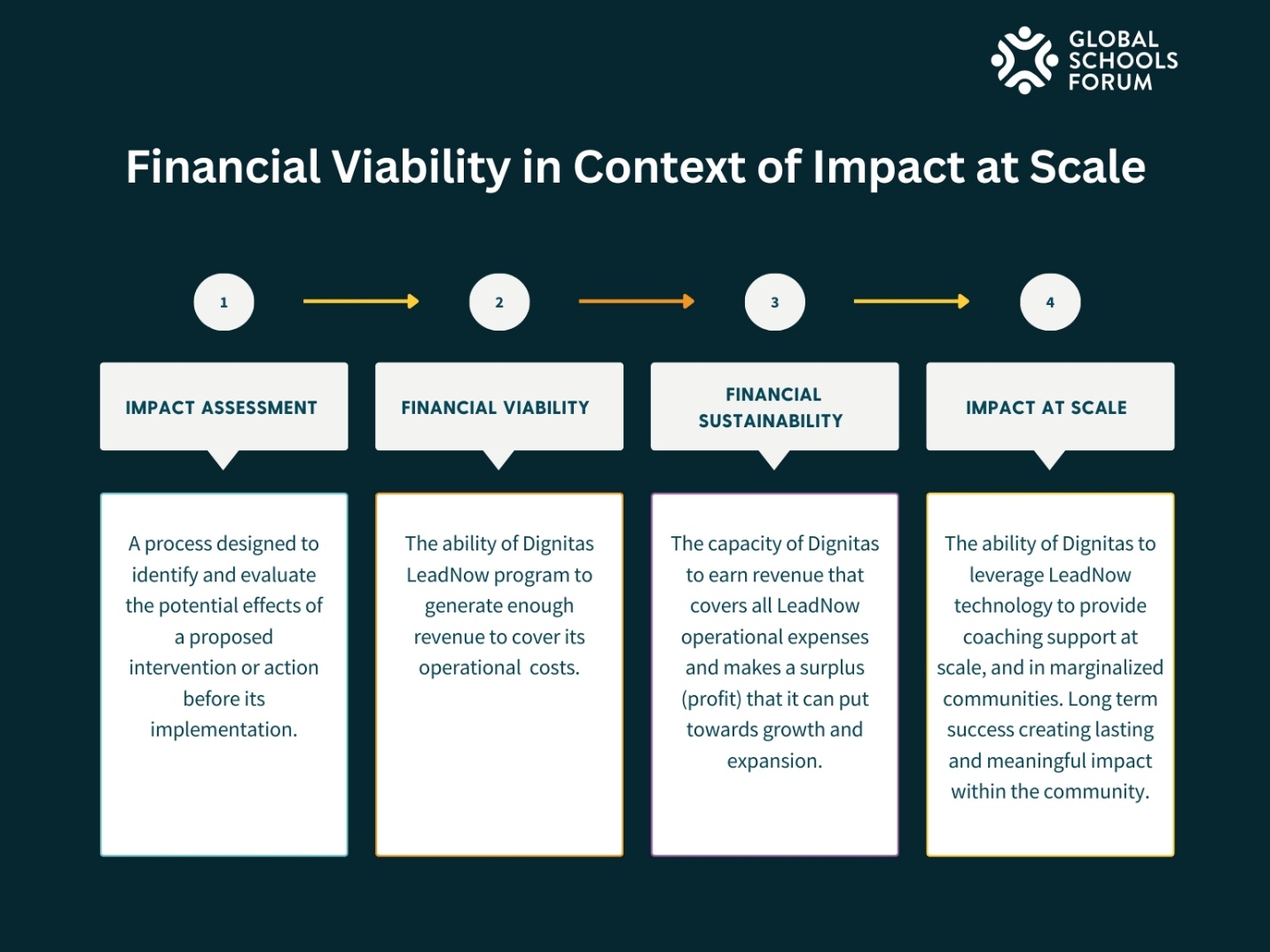

4. Placing Financial Viability in the Wider Context of Impact at Scale:

When organisations place financial viability at the heart of their program’s vision, they can achieve financial sustainability and impact at scale. The building blocks/milestones are necessary to drive a successful implementation.

5. The Significance of User-Payer Segmentation:

The User-Payer segmentation work is critical. This enables the organization to define who can pay for their services and build a marketing plan to target these payers. In the example of Dignitas, low earnings and economic hardships hinder a service user's ability to pay, so a comprehensive approach to segment B2B and B2C users is key. This builds on the brainstorming sessions led by Impact at Scale Labs on pricing and sales strategies for the Dignitas LeadNow solution.

6. Diversification of Funding Key for Financial Viability and Sustainability:

Diversification of funding sources is critical for growth and development and eventually impact at scale for any social impact organization. In the case of Dignitas, the output from the brainstorming sessions led by Impact at Scale Labs provides a good starting point, highlighting some recommendations and successful approaches that might help organizations explore diversification of funding approaches. For others, this might mean collaborating with strategic partners or consulting experts to craft a shared vision of scale and explore scale pathways and funding options.

7. Organizational Capacity and Capability Critical to Success:

The ability to successfully and sustainably implement LeadNow requires the right capacity and capability. Organizations must ensure key roles are identified and the right structures are in place to support implementation.

_______________________________________________________________________________________

Introduction and Context:

Dignitas’s LeadNow programme is an innovative, award-winning virtual training and coaching toolkit. Launched in 2021, the tool has been tested with 3,000 leaders (www.leadnow.dignitasproject.org).

In 2023 Dignitas joined Global Schools Forum’s Impact at Scale Labs programme, to explore pathways to scale LeadNow. Dignitas had already conducted the impact assessment and had the data for the financial viability assessment. Under the Impact at Scale Labs programme, Dignitas received support to strengthen their approach to financial viability and develop a strategy for financial sustainability. This case study introduces the financial viability lens used with Dignitas and highlights the processes Dignitas took towards strengthening their case for financial viability.

Financial Viability Lens:

The application of a financial viability lens on LeadNow involves:

- providing the building blocks to calculate the financial viability of LeadNow growth.

- what financial viability tools does Dignitas need for LeadNow's current growth stage?

- what financial viability building blocks does Dignitas need when scaling up the LeadNow Program?

- Introducing an approach to prioritizing scaling up initiatives.

- how does Dignitas prioritize its scale-up efforts?

- What resources and capacity are required?

The Process:

This section summarises the steps to apply the financial viability lens and develop the building blocks for Dignitas as they pursued the LeadNow growth and development strategy. Although focused on Dignitas, these steps can guide social impact organizations on their journey.

Step 1: Clearly articulate the scope:

In this case, the scope was to provide the financial viability building blocks and map out milestones to prepare LeadNow for the next stage of scaling up.

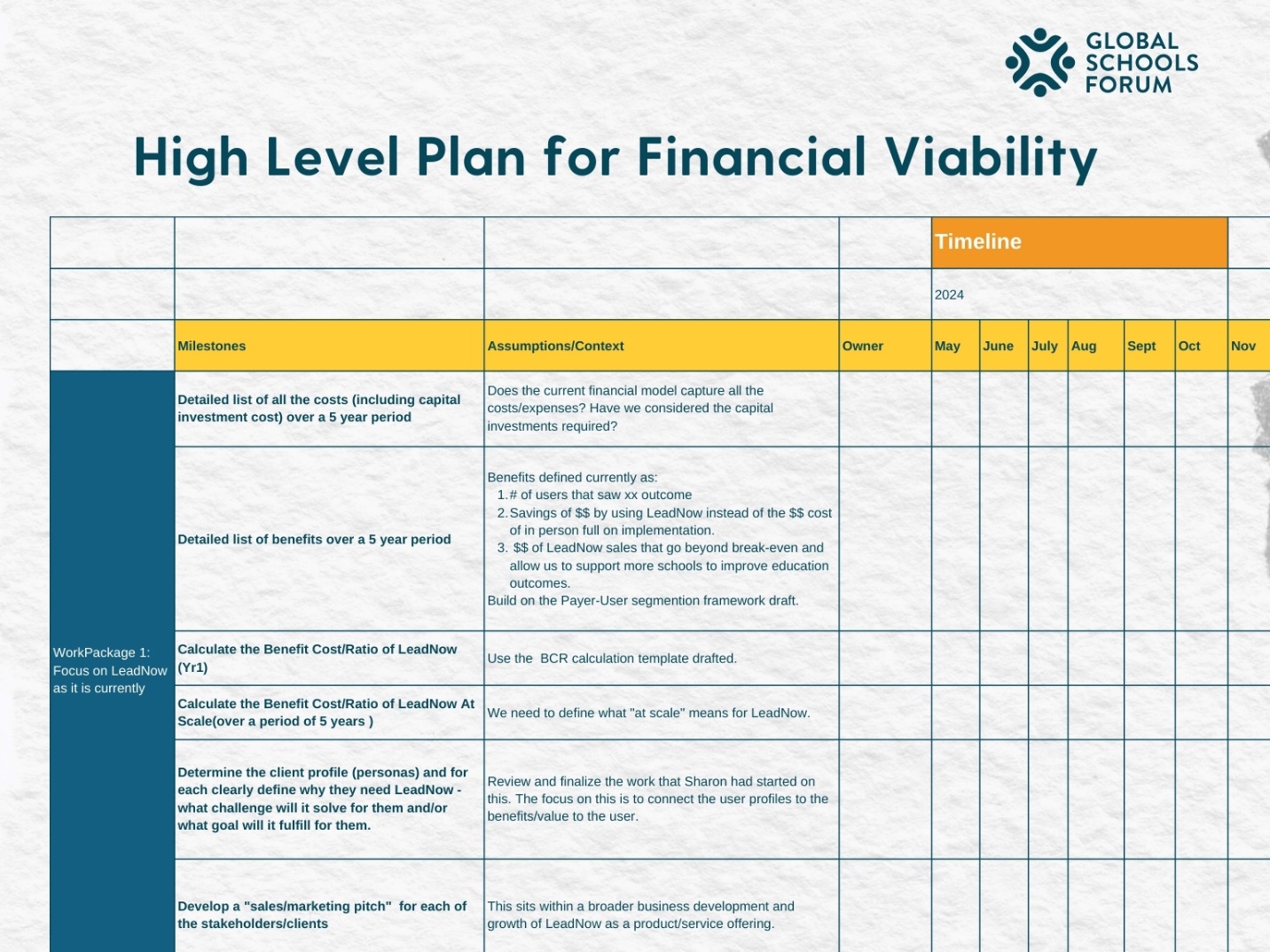

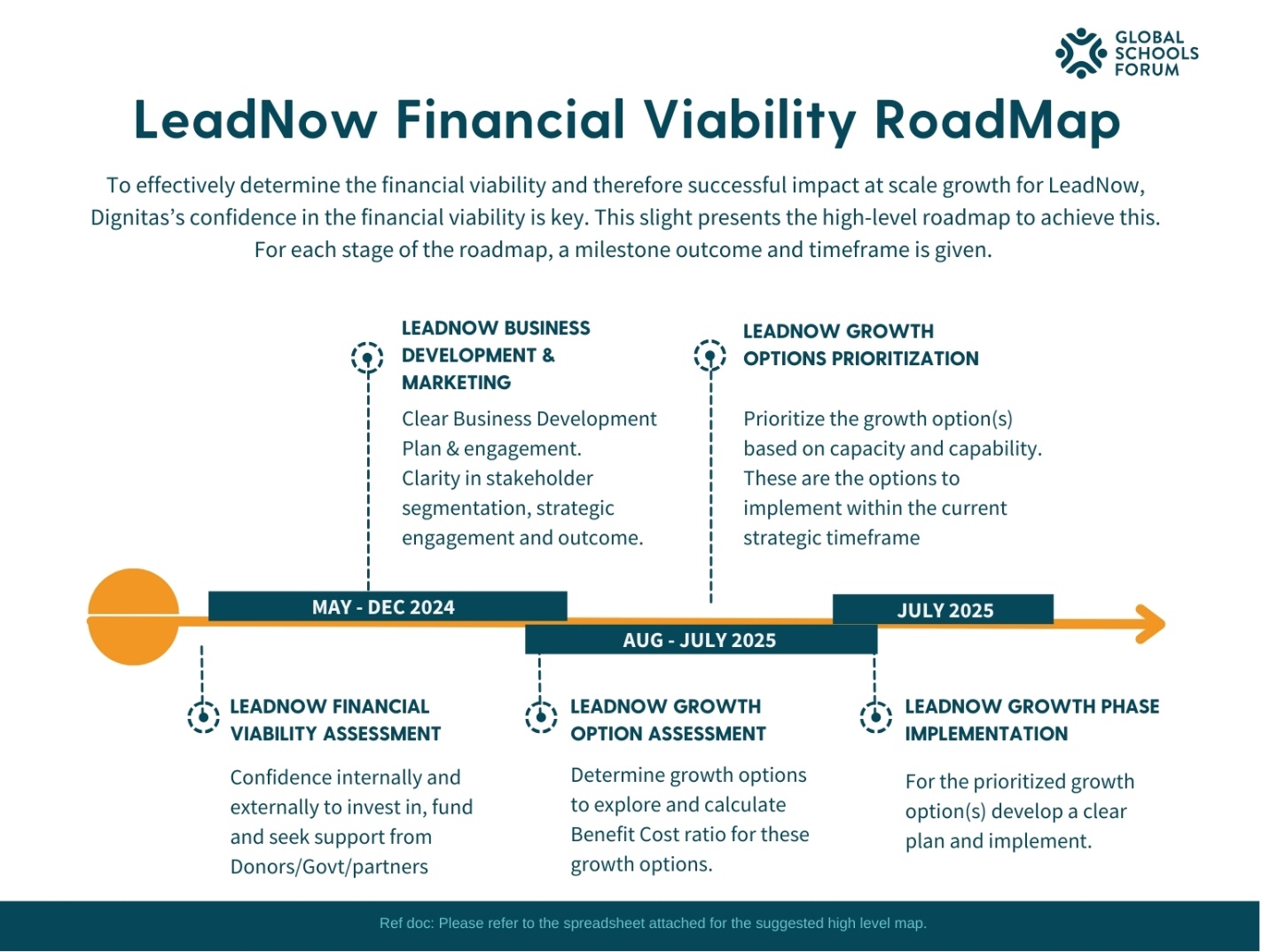

Step 2: Develop a simple and effective Roadmap.

The roadmap developed provided clear building blocks for Dignitas to assess LeadNow’s financial viability and lay out the scale-up path. For each stage, a milestone, outcome, and timeframe were included.

Step 3: Outline a high-level plan.

Dignitas developed a plan to identify work to be done with key milestones. This plan provided Dignitas with clarity on where to focus their efforts and highlighted specific outcomes. This activity built their confidence that LeadNow is financially viable, and they used that approach to determine and prioritize scale-up approaches.

Download the High-Level Plan for Financial Viability template here

Step 4: Market Research and Pricing Strategy Approach.

This process established the most effective financial model for Dignitas to use to assess the financial viability of LeadNow. Dignitas identified the cost of LeadNow as well as its benefits/value. These building blocks were key for financial viability assessment.

A: Benefit Definition:

To determine the financial viability of LeadNow, the team needed to quantify benefits. The first step was to define what benefit meant. The team defined LeadNow benefits as:

- Number of users that saw xx outcome

- $$ Savings by using LeadNow instead of the $$ cost of in-person full-on implementation.

- $$ of LeadNow sales that go beyond break-even and allow us to support more schools to improve education outcomes.

It is critical to quantify benefits as accurately as possible to evaluate financial viability. Due to the challenges of quantifying the benefits of education services or public service, Dignitas articulated and built in some assumptions while quantifying LeadNow’s financial benefits.

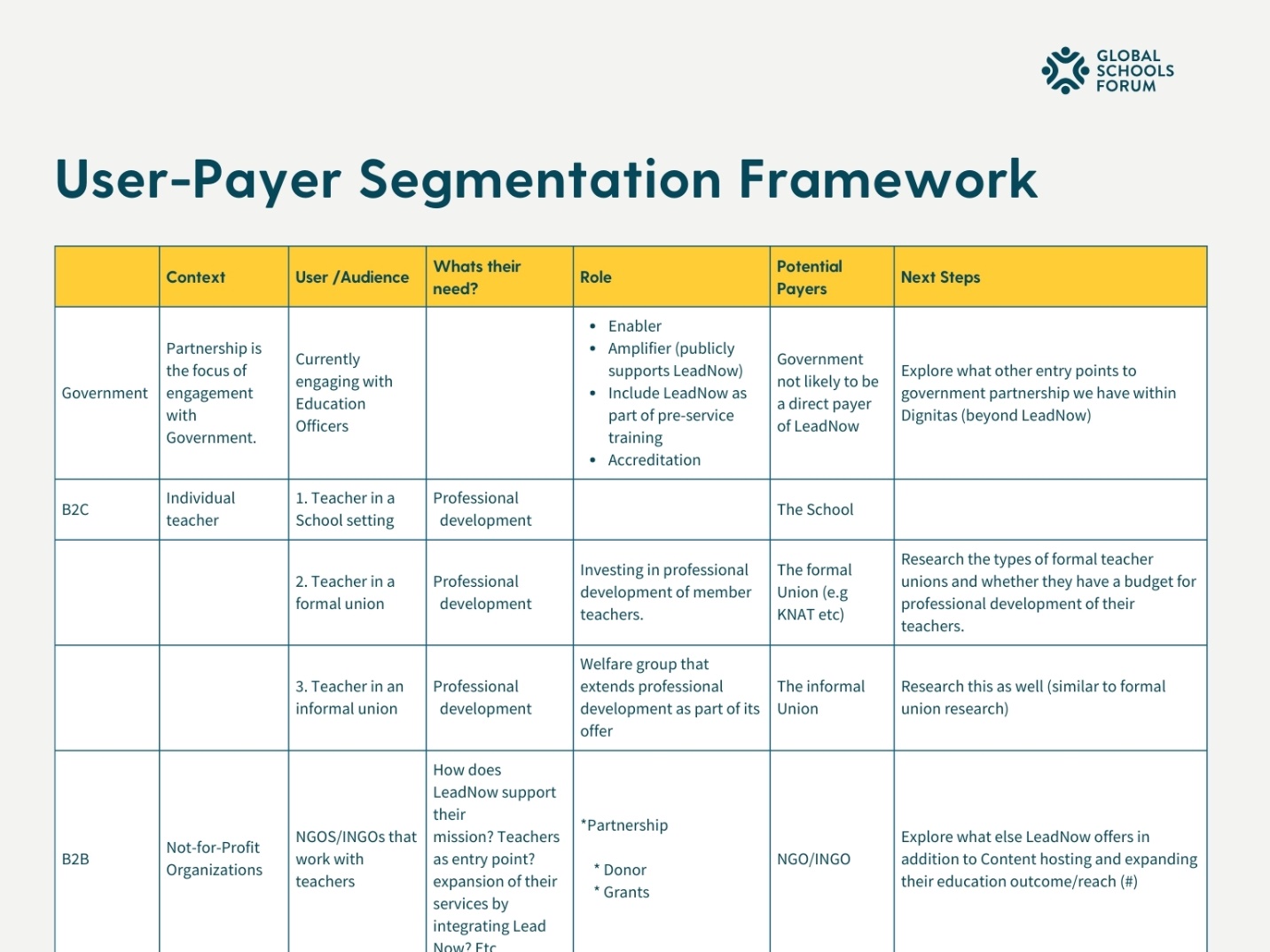

B: Payer User Segmentation approach:

Following brainstorming workshops with the team, Dignitas received a Payer-User segmentation approach as a starting framework to address this. The main purpose was to identify segments of key stakeholders (B2B or B2C) that would either use LeadNow or pay for LeadNow services and each segment:

- Outline their profile: relationship to Dignitas and LeadNow

- Identify their need.

- Determine their role.

- Determine whether they are potential payers.

- Outline the next steps.

The outcome of the Payer-User Segmentation would determine the income part of the financial model.

Download the full User-Segmentation Framework here

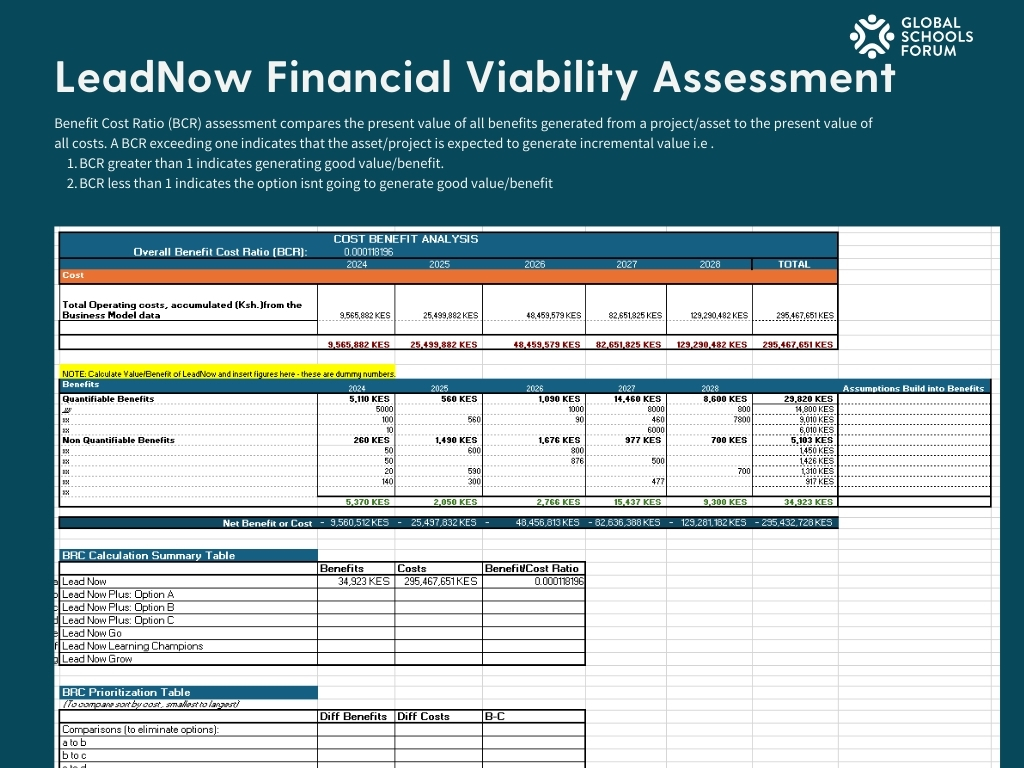

Step 5: Determine the Financial Viability calculation model.

Download the full LeadNow Financial Viability Assessment here

To effectively, assess the financial viability and growth options of LeadNow, a Cost-Benefit Analysis approach was introduced - specifically the Benefit Cost Ratio (BCR) assessment approach. The BCR approach will enable Dignitas to effectively assess the cost and benefits of LeadNow and enable Dignitas to confidently decide which option has the greatest benefit and the lowest cost to maximize “profit” (value/benefit) and impact.

A BCR assessment compares the present value of all benefits generated from a project/asset to the present value of all costs.

- A BCR greater than 1 indicates the asset would generate good value/benefit.

- BCR less than 1 indicates the option isn’t going to generate good value/benefit.

Step 6: Build the Cost-Benefit Model.

Incorporating Dignitas’s LeadNow cost model, a template that included the BCR calculation was provided. Taking this template, Dignitas would then:

- Ensure the Cost Model figures have included all costs (especially investment costs).

- Using the Benefits calculation work, populate the quantifiable and non-quantifiable benefits of LeadNow for Year 1- Year 5.

- This will then automatically calculate LeadNow's BCR value. The BCR level needs to be greater than 1 to indicate its financial viability.

- This same process and approach will apply when calculating the financial viability of the growth options that Dignitas wants to explore.

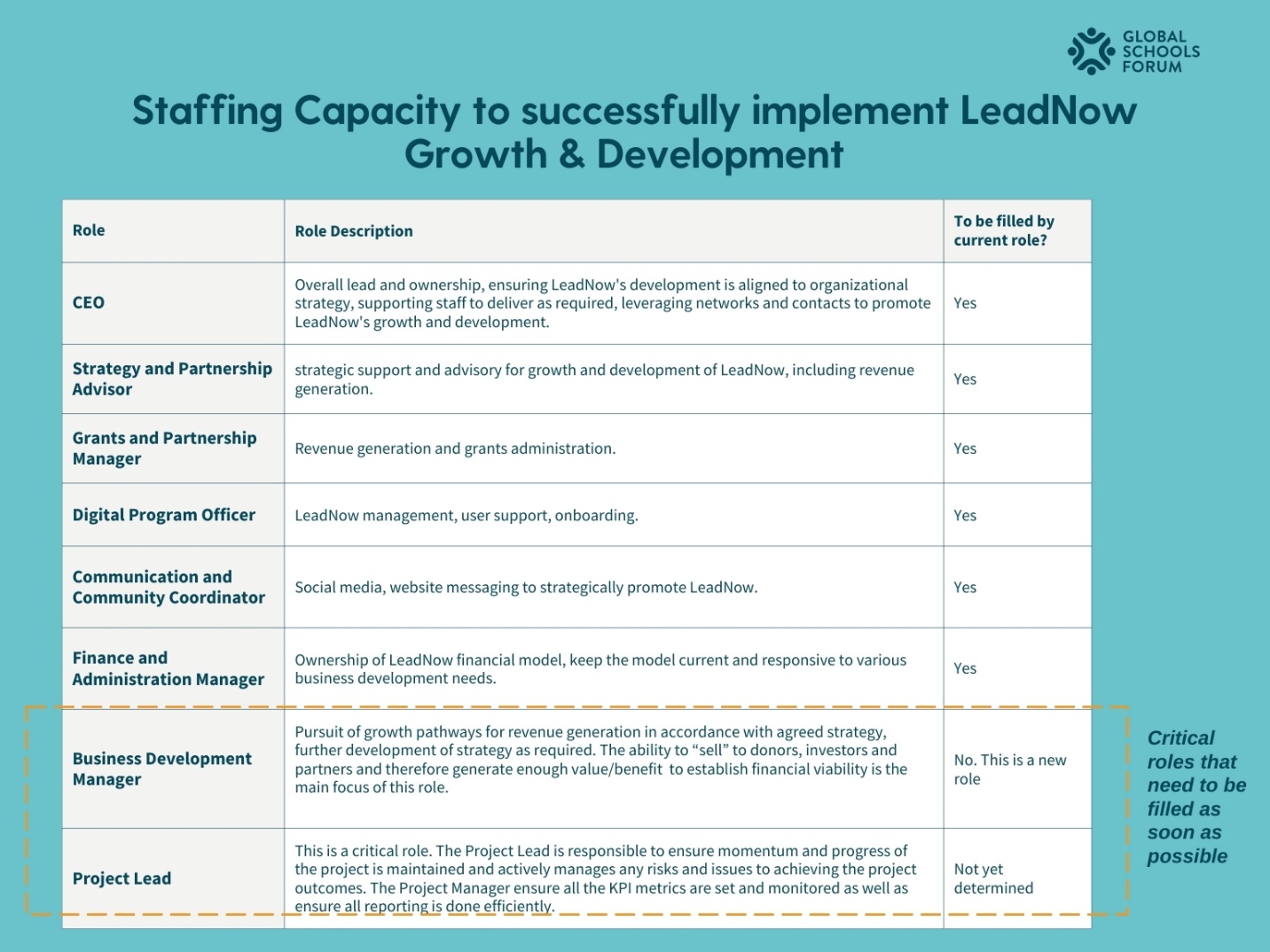

Step 7: Determine the staffing capacity required.

It is obvious that with the shift in mindset and approach towards financial viability, Dignitas would need to reflect on its current capacity, structures and capability and identify the change required to support a successful transition. A high-level review of roles was conducted and based on that, key role profiles were suggested. This role review captured the immediate LeadNow roles as presented during the case study and did not go into the capacity and capability required to support Dignitas’s broader financial viability journey.

Conclusion:

The path to financial viability sits within a broader context of viability and the DVF Scale Framework. Therefore, organisations seeking to implement programs at scale must consider this early in their journey as functionality and impact may be compromised if not underpinned by financial viability. Dignitas can ensure LeadNow’s long-term sustainability and impact by broadening its mindset and approach towards financial viability; reflecting on its brand and identity, diversifying its sources of income; skillfully managing its finances; and making financial sustainability a top priority.

Fostering a sustainable financial foundation not only empowers Dignitas to better serve its mission but also strengthens donor confidence, enhances resilience against external shocks, and contributes to LeadNow's long-term success and impact.